Company Analysis

Essential data and analytics on every US public company including performance, teams, governance, red flags, insider trading, filings, and more.

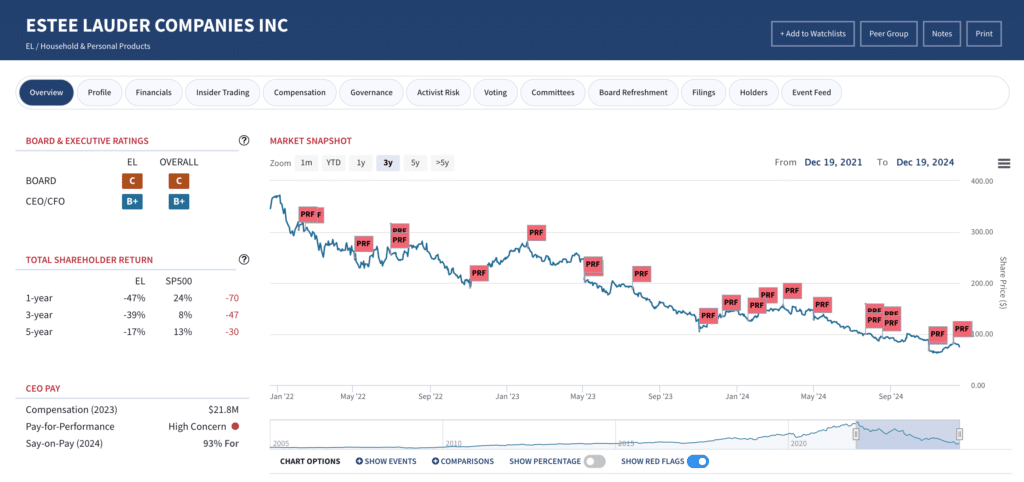

Fast, Intuitive Insights Into Company Performance and Problems

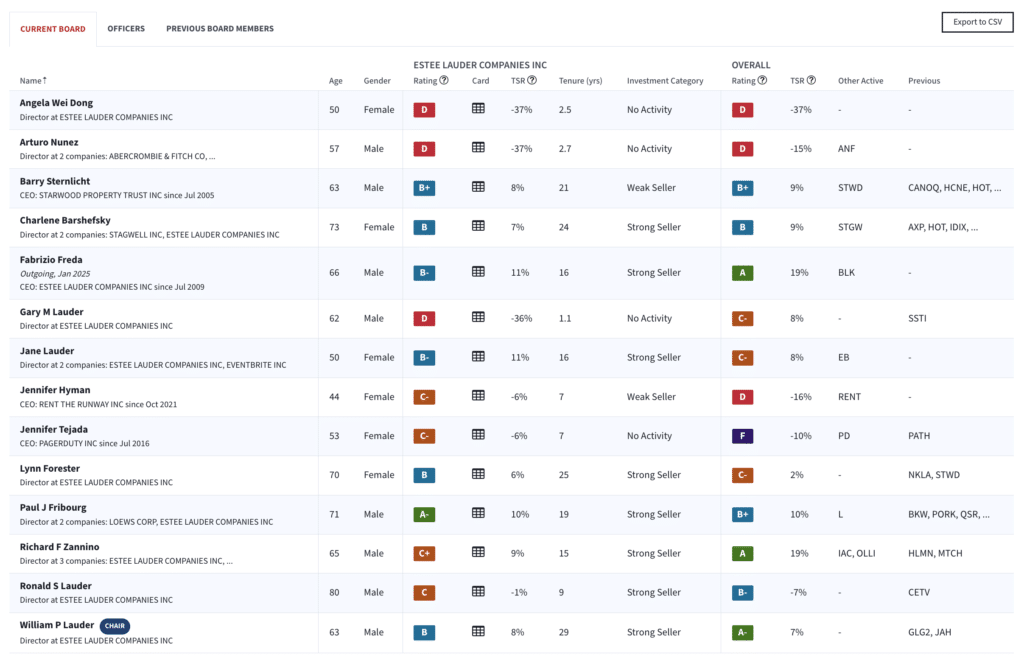

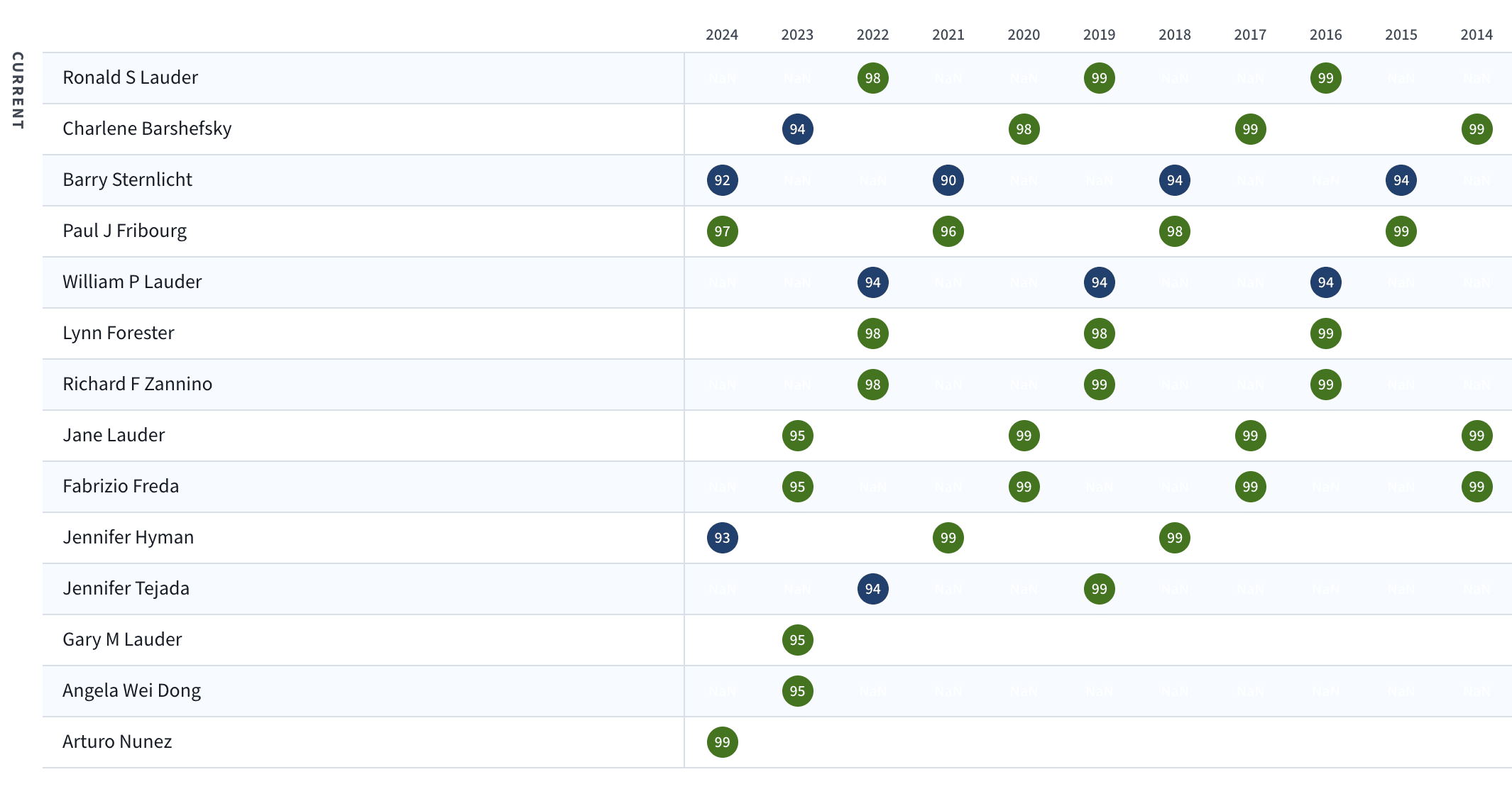

Know every director and officer’s track record in seconds with comprehensive summaries of their roles, performance, compensation, insider buying/selling, shareholder support, and more.

Know the Board and Executives

Essential visibility into the current board and executives’ track record at the company in question and all of their other tenures as an executive or director.

Quickly know their tenures, performance, buying/selling behavior, shareholder support, and more. Performance scorecards provide immediate, fact-based assessments.

Dive deep on each executive and director with comprehensive profiles.

Performance & Governance Red Flags

Monitor for the potential governance red flags that investors, proxy advisors, and others are watching for.

The platform tracks over 100 potential red flags across performance, governance, activism, SEC filings/actions, cybersecurity, legal activity, and more.

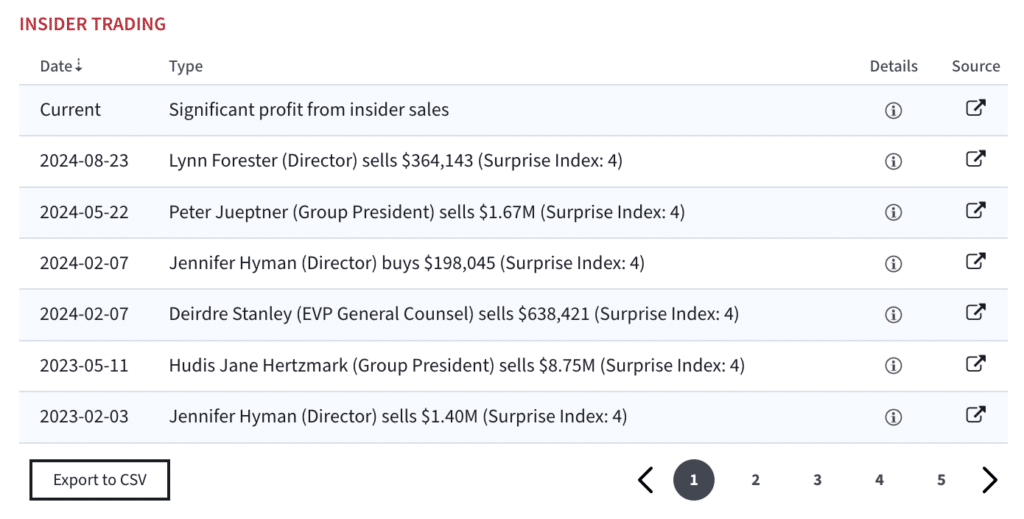

Insider Trading Analytics

Track every insider trade. Separate everyday trading from surprising, interesting trading activity.

Monitor insider disclosure of new, cancelled, or altered 10b-5 trading plans.

Red flags when insiders are significantly profiting from their sales, collective selling is unusual, or when individual trades warrant closer review.

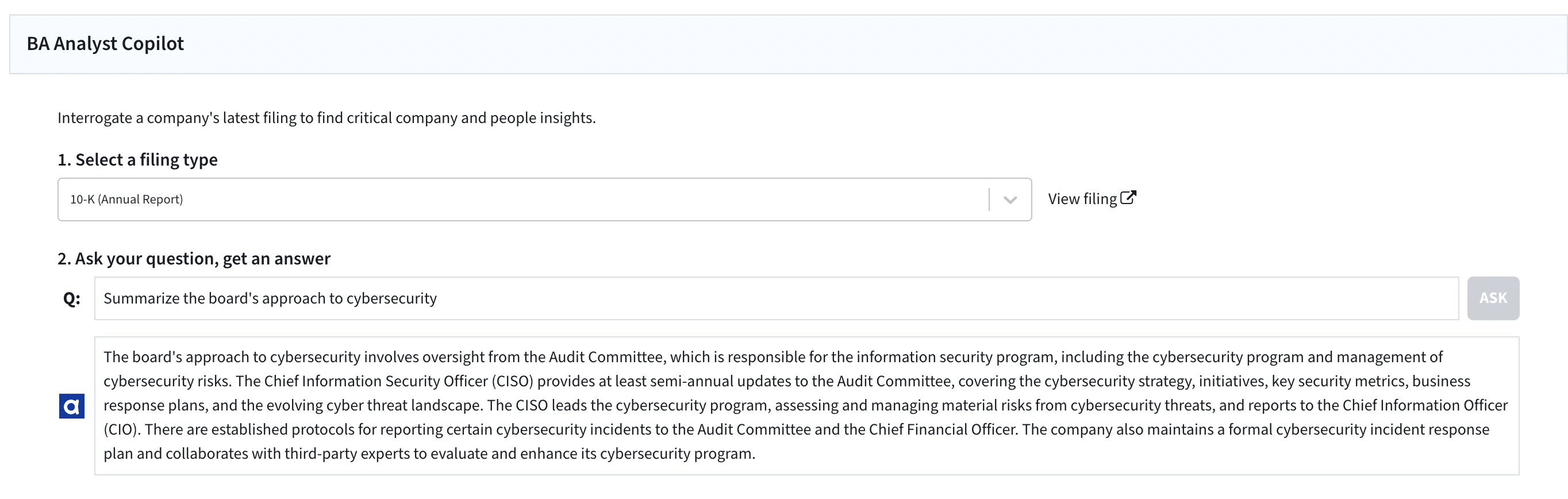

SEC CoPilot for Accelerated Research

Use the Boardroom Alpha SEC CoPilot to accelerate research based on SEC filings for every company.

Ask complex questions, get clear, value-add answers quickly.

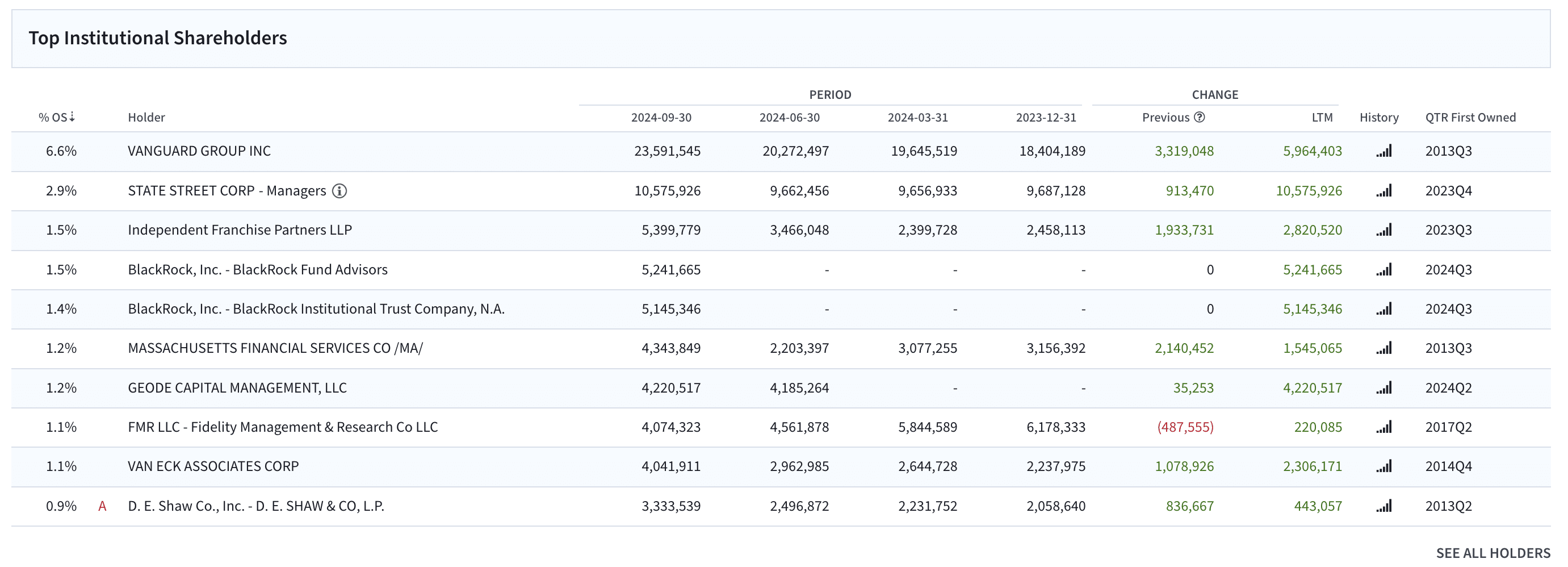

Track Institutional & Activist Holders

Full visibility into shareholders at every company. All institutional funds and activists have dedicated profiles that track their holdings over time, activist activity, filings, and contacts.

Track Director Election Support

Ensure the board has the right mix to provide the needed perspectives. Ensure the board isn’t entrenched or doesn’t meet your diversity standards.

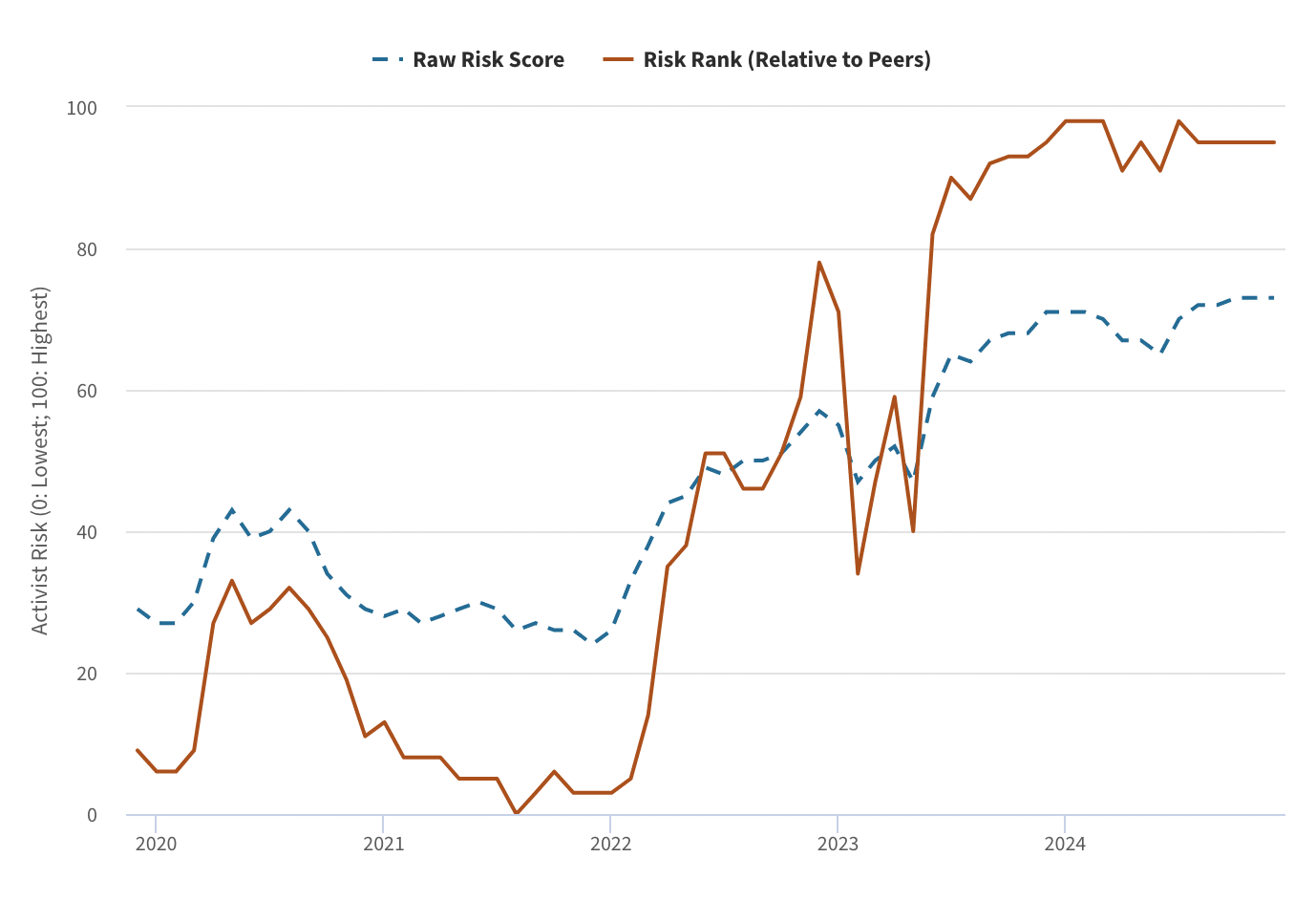

Activist Vulnerability Assessments

Assess vulnerability to activism based on company fundamental performance relative to peers, executive metrics, and stock performance.

Compare across peers in similar industries/sectors. Screen and filter for companies with high vulnerability scores to identify potential future activist targets.

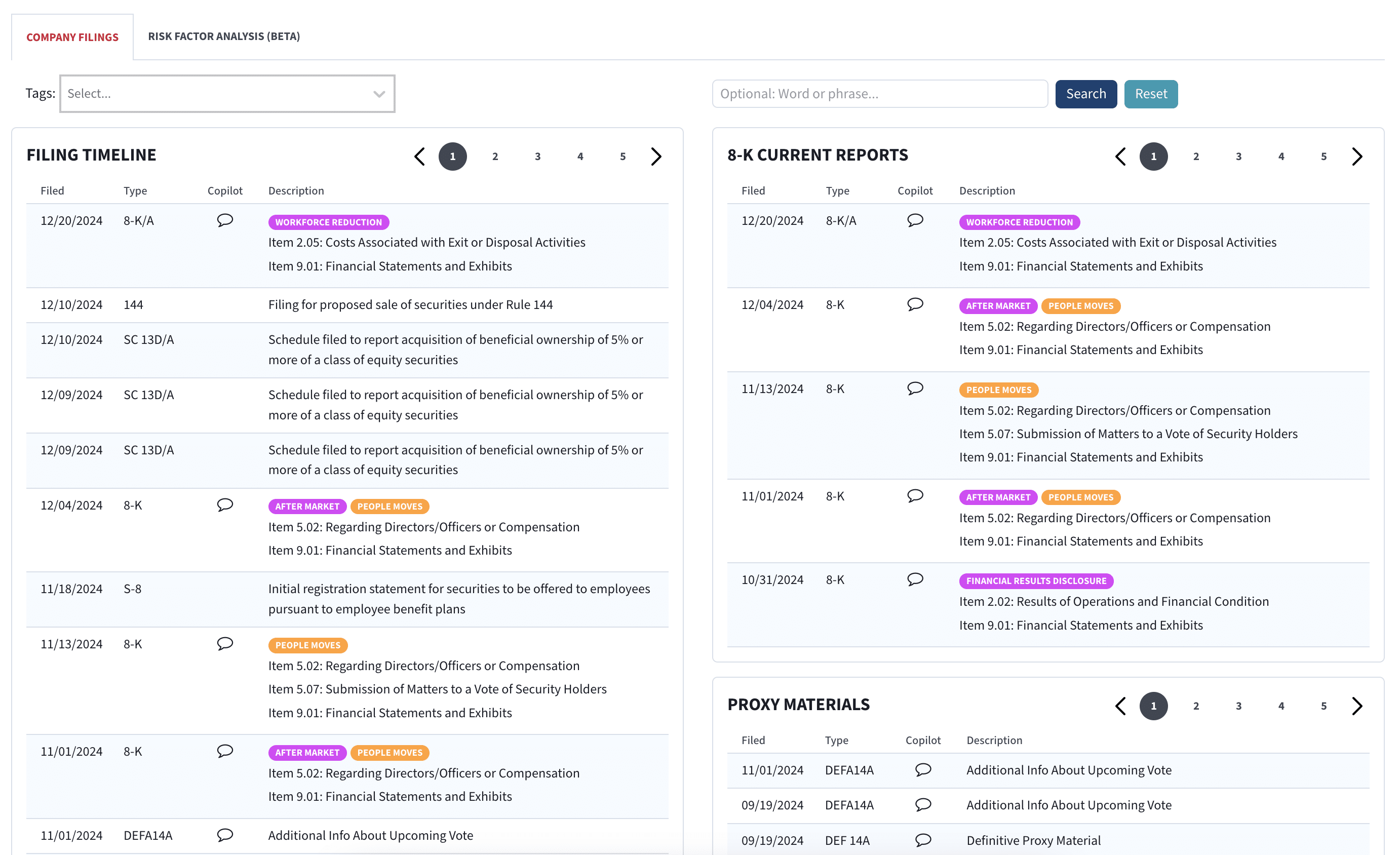

AI-Powered SEC Filing Search & Review

Immediate access to the latest filings in a streamlined timeline and grouped according to content.

Real-time tagging and data extraction to quickly identify flags and facts.

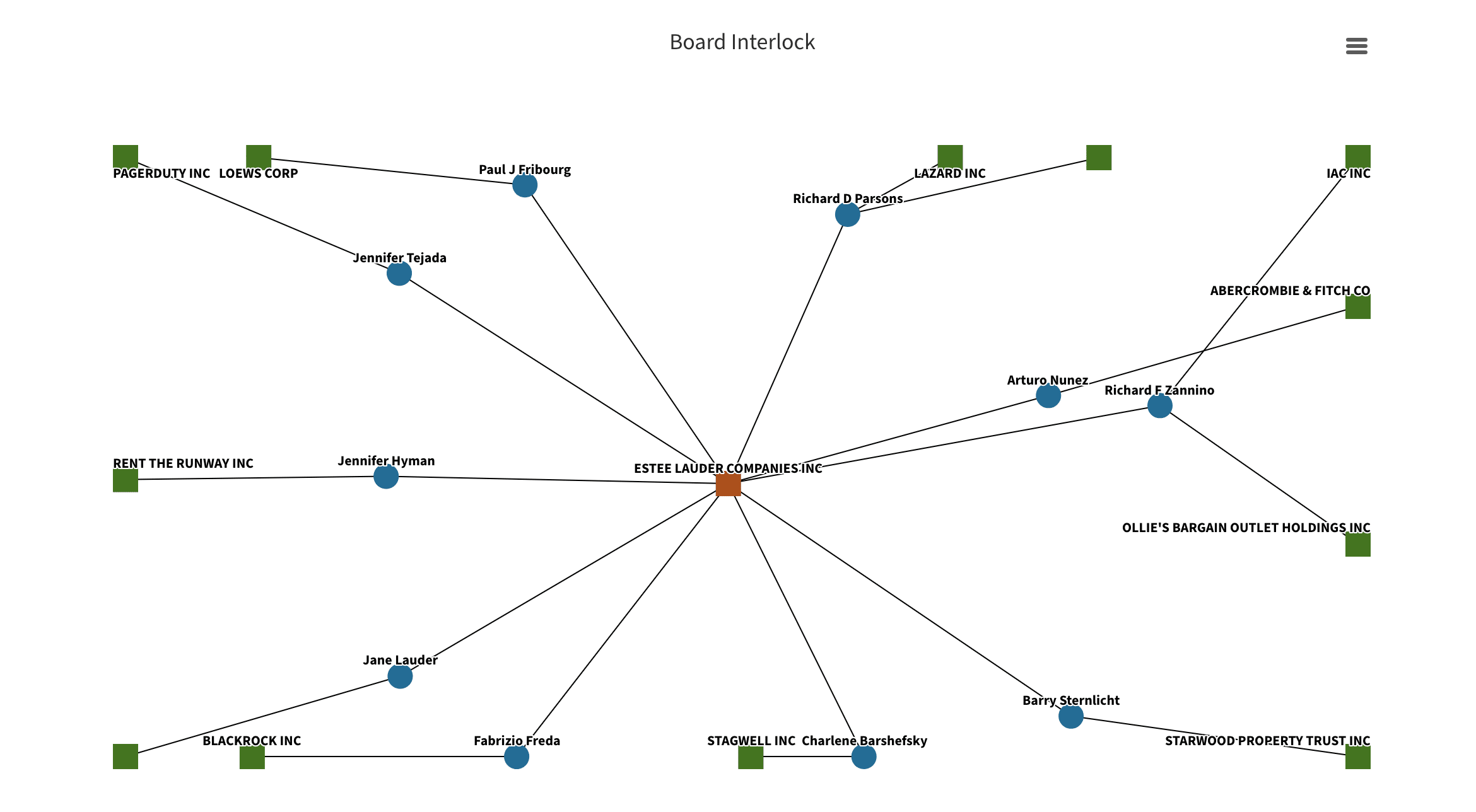

Board Interlock Analysis

Quickly assess potential board interlock flags that could raise concerns of collusion or overboarding.

Know how every director is connected to other companies and executives.

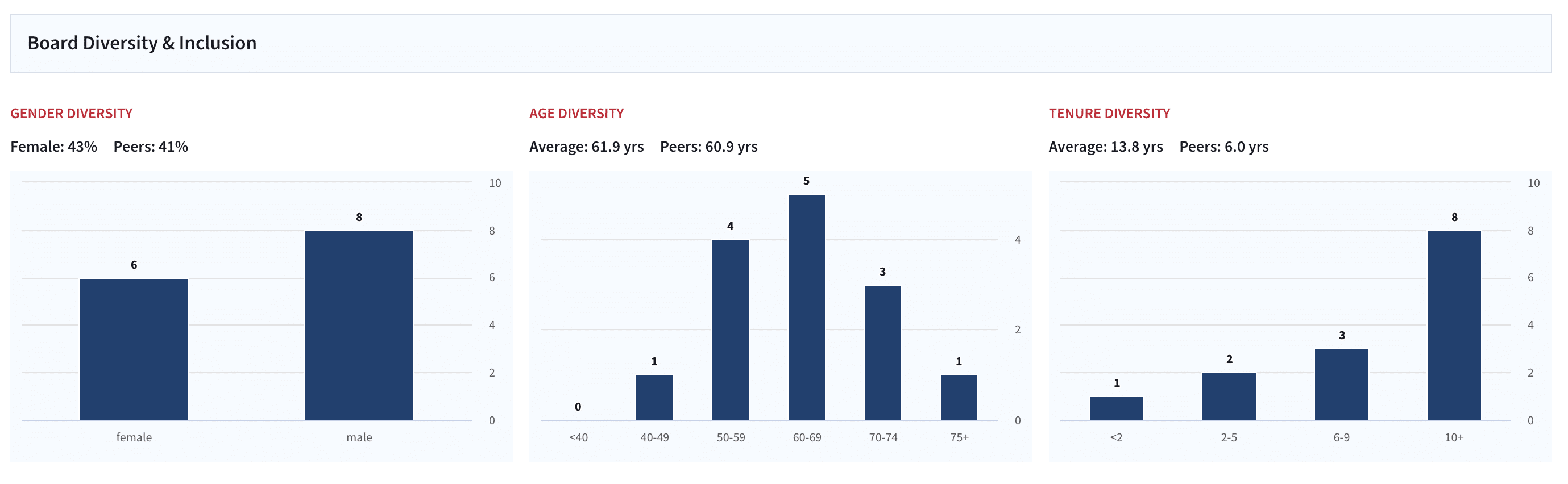

Board Diversity & Tenure

Ensure the board has the right mix to provide the needed perspectives. Ensure the board isn’t entrenched or doesn’t meet your diversity standards.

FAQ

How often are company data & analytics updated?

The Boardroom Alpha platform updates all data as it becomes available. Our ability to ingest and extract SEC data in near real-time makes the platform the most current view you can find.

Which companies does the platform cover?

The platform covers all US public companies that trade on the major stock exchanges. Coverage goes back to 2000.

Is there database or API access?

All of the Boardroom Alpha platform’s data and analytics are available via API and bulk downloads.

Customers often use our standard RESTful APIs or will ask us to create custom feeds to integrate into their databases/workflow.

Do you provide peer group Analysis?

The platform enables users to compare companies to a standard industry/sector, a custom user-defined peer set, or against the peers extracted from annual proxy filings.

Do you provide access to SEC filings?

Yes, we ingest SEC filings in real-time and make those available throughout the platform. In addition, we leverage AI to enrich and extract critical information from every filing.

Are SEC filings alerts available?

Yes, subscribers can choose to subscribe to daily summary emails based on their watchlists or choose specific companies/filings to receive updates on throughout the day.

Can I create watchlists of companies?

Yes, users typically have multiple watchlists that are focused on their portfolios, customers, or targets.

Watchlists can contain either people or executives and power user dashboards and alerts.

A Title to Turn the Visitor Into a Lead

This is your chance to emphasize why the visitor should contact you right now.