SPAC Deal for 8i Acquisition 2 Corp. (LAX) and EUDA Health. A look at upcoming merger and extension votes. And the rest of the day’s news in SPACs.

————————————————-

Free Investor Resources from Boardroom Alpha

—————————————————-

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

SPAC Deal: 8i Acquisition 2 Corp. (LAX) + EUDA Health

8i Acquisition 2 Corp.(LAX) announced a definitive agreement to merge with Singapore-based digital health platform EUDA Health. The deal values EUDA Health at an enterprise value of $673M. No PIPE. Cash proceeds raised will consist of 8i’s approximately $86.3 million of cash in trust (before redemptions). Additional earnouts in the form of 9 million total shares will be awarded post-transaction close if EUDA’s share price reaches $15, $20 and $25 over three years. Slide deck here.

L&F Acquisition Corporation I (LNFA) Extends

L&F Acquisition Corp. (LNFA) sets 5/3 extension vote (out to August). $10.15 in trust. The SPAC has a pending deal announcement with ZeroFox since Dec.

$LNFA sets 5/3 extension vote (out to August). $10.15 in trust. pending DA with ZeroFox since Dec.

— Boardroom Alpha (@boardroomalpha) April 12, 2022

SEC not moving fast on these SPAC dealshttps://t.co/oBu2Jjr1Zg pic.twitter.com/yfUMdziV5r

Elsewhere in SPACs

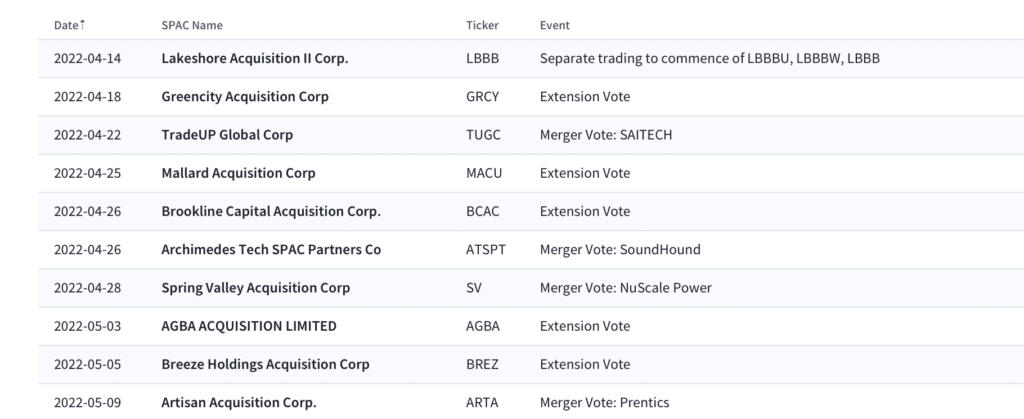

Upcoming Merger and Extension Votes

More from Boardroom Alpha

For ongoing tracking, analytics, and data on SPACs checkout Boardroom Alpha’s SPAC Data and Analytics service.