Yes, SPAC IPOs are still pricing (slowly). Trouble is, last year’s bubble valuations are making deals tougher to execute as committed financing dries up. Expect more cancellations.

————————————————-

Free Investor Resources from Boardroom Alpha

————————–————————–

** Podcast: Know Who Drives Return

** Daily SPAC Newsletter

** Full SPAC Listing

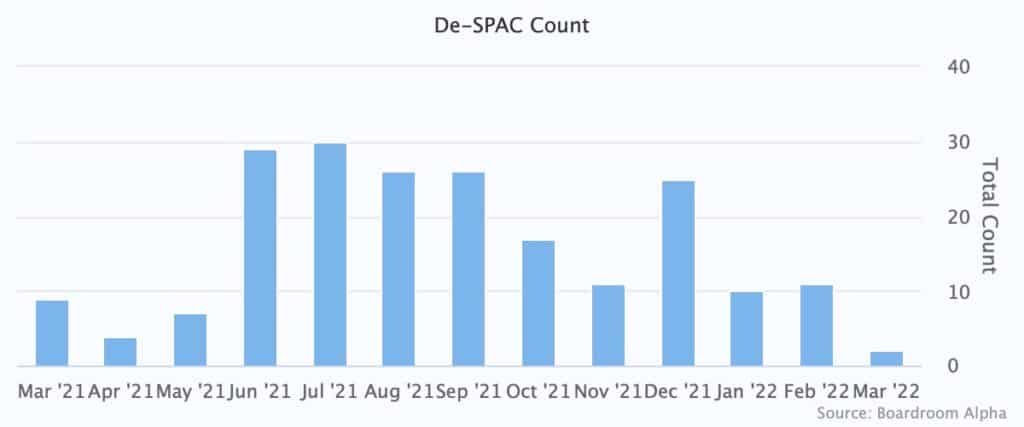

Yes, SPAC IPOs are still happening, even if the pace is down to a trickle. 6 IPOs so far this month, down from 20 in February and 109 last March.

SPAC IPOs down to a trickle

But as we’ve seen in recent weeks, even SPACs with DAs aren’t out of the woods yet. Without committed financing, we are starting to see many SPAC deals priced at aggressive 2021 valuations fall through the cracks. Expect to see more sweeteners and especially deal cancellations as we navigate volatile markets for the foreseeable future.

So far in March, we’ve seen 2 deSPACs make it out of the gate, down from 9 last year.

Not surprisingly, market volatility is closing the exits

NUBI prices $110M IPO

Nubia Brand International (NUBI) priced a $110M IPO: 1/2W, $10.20 trust. Targeting wireless telecom. Patrick Orlando of Digital World Acquisition Corp. (DWAC) is a “special advisor” to the board. The SPAC will be led by CEO Jaymes Winters, and CFO Vlad Prantsevich.

EF Hutton, division of Benchmark Investments, LLC, is acting as the sole book running manager for the offering.

FMAC sweetens terms for shareholders ahead of Starry Merger

FirstMark Horizon (FMAC) reminds investors that its sweetened the deal for its proposed merger with Starry. The company is allocating an additional 1M shares to non-redeeming stockholders. 2.4M shares out of 41.4M public shares have agreed not to redeem in exchange for bonus shares.

$FMAC FirstMark Horizon non-redemption agreement for Starry deal

— Boardroom Alpha (@boardroomalpha) March 9, 2022

2.4M shares (out of 41.4M public shares) agree not to redeem in exchange for bonus shareshttps://t.co/FF9bu53uCJ pic.twitter.com/t6lErMMy1g

RCFLU/Gett terminate deal

Rosecliff Acquisition Corp. (RCFLU) terminated its merger agreement with Gett as a result of “recent market volatility.” Gett, a corporate ground transportation management (GTM) technology platform, says it exit the Russian market permanently. The company expects to enter 2023 as a “fast-growing and profitable company that will be ready to go public when markets return to a more actionable state.” Rosecliff will keep looking for a deal. A prospectus wasn’t even filed for this one.

Biggest SPAC Movers

Biggest SPAC Gainers

4.44% ~ $ 9.40 | BTNB – Bridgetown 2 Holdings Limited (Announced)

2.45% ~ $ 11.71 | CFVI – CF Acquisition Corp. VI (Announced)

1.54% ~ $ 71.37 | DWAC – Digital World Acquisition Corp. (Announced)

.91% ~ $ 9.95 | DNAA – Social Capital Suvretta Holdings Corp. I (Announced)

.89% ~ $ 10.21 | MEKA – MELI Kaszek Pioneer Corp (Pre-Deal)

.62% ~ $ 9.80 | RVAC – Riverview Acquisition Corp. (Pre-Deal)

.61% ~ $ 9.88 | LCW – Learn CW Investment Corp (Pre-Deal)

.61% ~ $ 9.91 | PORT – Southport Acquisition Corporation (Pre-Deal)

.51% ~ $ 9.80 | PRPC – CC Neuberger Principal Holdings III (Pre-Deal)

.51% ~ $ 9.89 | VGII – Virgin Group Acquisition Corp. II (Announced)

.51% ~ $ 9.95 | SVNA – 7 Acquisition Corp (Pre-Deal)

.50% ~ $ 9.96 | VCXB – 10X Capital Venture Acquisition Corp. III (Pre-Deal)

.46% ~ $ 9.78 | LDHA – LDH Growth Corp I (Pre-Deal)

.45% ~ $ 10.02 | GACQ – Global Consumer Acquisition Corp. (Announced)

.41% ~ $ 9.76 | VAQC – Vector Acquisition Corporation II (Pre-Deal)

.41% ~ $ 9.78 | TWNI – Tailwind International Acquisition Corp. (Pre-Deal)

.41% ~ $ 9.82 | MON – Monument Circle Acquisition Corp (Pre-Deal)

.41% ~ $ 9.88 | SPAQ – Spartan Acquisition Corp. III (Announced)

.40% ~ $ 9.94 | OCA – Omnichannel Acquisition Corp (Pre-Deal)

.40% ~ $ 9.97 | APN – Apeiron Capital Investment Corp. (Pre-Deal)

Biggest SPAC Losers

-20.02% ~ $ 7.95 | FMAC – FirstMark Horizon Acquisition Corp (Announced)

-1.92% ~ $ 9.71 | CPAA – Conyers Park III Acquisition Corp. (Pre-Deal)

-1.15% ~ $ 9.44 | MOTV – Motive Capital Corp (Announced)

-1.11% ~ $ 9.73 | TCOA – Trajectory Alpha Acquisition Corp. (Pre-Deal)

-.82% ~ $ 10.89 | GGPI – Gores Guggenheim, Inc (Announced)

-.60% ~ $ 9.89 | MCAF – Mountain Crest Acquisition Corp. IV (Pre-Deal)

-.53% ~ $ 9.84 | DAOO – Crypto 1 Acquisition Corp (Pre-Deal)

-.52% ~ $ 9.65 | APMI – AxonPrime Infrastructure Acquisition Corp (Pre-Deal)

-.51% ~ $ 9.76 | RCLF – Rosecliff Acquisition Corp I (Pre-Deal)

-.51% ~ $ 9.80 | INAQ – Insight Acquisition Corp. (Pre-Deal)

-.50% ~ $ 9.87 | ACAB – Atlantic Coastal Acquisition Corp. II (Pre-Deal)

-.50% ~ $ 9.92 | MNTN – Everest Consolidator Acquisition Corp (Pre-Deal)

-.50% ~ $ 10.00 | DTRT – DTRT Health Acquisition Corp. (Pre-Deal)

-.44% ~ $ 10.14 | ADOC – Edoc Acquisition Corp (Announced)

-.40% ~ $ 9.87 | BNIX – Bannix Acquisition Corp. (Pre-Deal)

-.40% ~ $ 9.87 | ARTE – Artemis Strategic Investment Corporation (Pre-Deal)

-.40% ~ $ 10.07 | HUGS – USHG Acquisition Corp. (Announced)

-.31% ~ $ 9.70 | JUGG – Jaws Juggernaut Acquisition Corporation (Pre-Deal)

-.31% ~ $ 9.78 | NHIC – NewHold Investment Corp. II (Pre-Deal)

-.31% ~ $ 9.80 | MCAG – Mountain Crest Acquisition Corp. V (Pre-Deal)

Know Who Drives Return Podcast

Boardroom Alpha’s team talks to the public company and SPAC leaders that are driving return for shareholders, delivering on ESG promises, and more.

See all the episodes here and make sure to subscribe using your favorite podcast app so you don’t miss a single episode.

Recent podcasts

- Update on Activism and Universal Proxy with Michael R. Levin

- AON’s Aria Glasgow on Managing ESG and Human Capital Risk

- Korn Ferry’s Anthony Goodman on the Importance of Board Evaluations

- Podcast: Getaround CEO Sam Zaid on Carsharing and Going Public

- What to Know about Universal Proxy with Bruce Goldfarb of Okapi Partners

- Podcast: Li-Cycle’s (LICY) Ajay Kochhar on Lithium Ion Battery Recycling and EVs

The Daily SPAC

Boardroom Alpha publishes daily SPAC market analysis at theStreet.com. Sign up for the newsletter and get it in your inbox daily. Get the Newsletter: Sign-up now!

- Daily SPAC Update – December 18, 2024More SPAC Delistings as Battery Future and Burtech Go Down. Integrated Wellnes and Spree Shareholders Approve Extensions. Mars Acquisition Deal Approved.

- Daily SPAC Update – December 17, 2024Winvest Acquisition (WINV) Extension Approved. Target Global Acquisition and IX Acquisition Delistings. WAVS and ALSA Set Extension Votes.

- Daily SPAC Update – December 16, 2024INAQ DeSPACs to Alpha Modus (AMOD) and IVCP DeSPACs to AleAnna Energy (ANNA). MITA Extension Vote Set. RRAC Moved to OTC. FACT Separate Trading on Dec 20.

- Daily SPAC Update – December 13, 2024Despite Delistings, Liquidations, and Failed Deals, SPAC IPOs Keep Coming. Roman DBDR Acquisition Corp. II (DRDB) $200M and Mountain Lake Acquisition Corp. $210M IPOs.

- Daily SPAC Update – December 12, 2024Swiftmerge Acquisition (IVCP) + AleAnna Energy Deal Vote. Mars Acquisition (MARX) + ScanTech Deal Vote. PRLH and IGTA Extensions Approved. IGTA to be Delisted.

- Daily SPAC Update – December 10, 2024Jackson Acquisition II $200M IPO (Jackson I Liquidated). APXI Shareholders Approve Extension w/ 5M Redemptions. HCVI Merger Amendment. SLAMF Vote Adjourned and IVCB Vote Postponed.

SPAC Monthly Market Reviews

- SPAC Market Review – April 2023

- SPAC Market Review – March 2023

- SPAC Market Review – February 2023

- SPAC Market Review – January 2023

- SPAC Market Review – December 2022

- SPAC Market Review – November 2022